Discover the mind-blowing Review of Rediff Money, packed with invaluable insights to revolutionize your financial journey. Don't miss out!

Are you tired of sifting through endless financial websites, desperately searching for accurate and up-to-date market information?

Well, get ready to have your mind blown by this review of Rediff Money - the ultimate game-changer in the world of finance!

With its user-friendly interface and powerful analytical tools, Rediff Money is the one-stop solution to all your investment needs.

Whether you're a seasoned trader or just starting out on your financial journey, this platform will revolutionize the way you manage your portfolio.

Say goodbye to sleepless nights and hello to unparalleled success with Rediff Money!

Exploring Rediff Money's features and benefits

Rediff Money offers a wide range of features and benefits that make it a game-changer for investors.

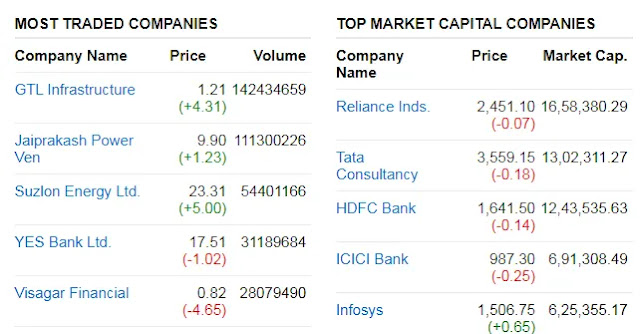

One of the standout features is its comprehensive stock market coverage.

Whether you are a beginner or an experienced investor, Rediff Money provides detailed information on various stocks, including live quotes, historical charts, financials, and news updates.

This allows users to stay informed and make well-informed investment decisions.

Another great feature of Rediff Money is its portfolio management tool.

With this tool, you can easily track your investments in one place and analyze their performance over time.

It also provides personalized alerts for any changes in your portfolio or specific stocks you are interested in.

This makes it easier to keep track of your investments and make timely adjustments if needed.

Furthermore, Rediff Money offers a variety of research tools to help investors make better investment decisions.

From technical analysis charts to fundamental data and expert opinions, there is something for everyone.

The platform also offers educational resources such as articles and tutorials that can help beginners learn about investing and improve their knowledge.

Overall, the features offered by Rediff Money go above and beyond what traditional finance websites provide.

Whether you are looking for real-time market information or tools to manage your portfolio effectively, Rediff Money has got you covered.

By utilizing these features, investors can take control of their finances with confidence and achieve their financial goals successfully

User Interface: Sleek, intuitive, and user-friendly

One of the standout features of Rediff Money is its sleek and intuitive user interface.

From the moment you land on the website, you are greeted with a clean and modern design that is pleasing to the eye.

The layout is well-organized, making it easy for users to navigate and find what they need.

But it's not just about looks - Rediff Money's user interface is also incredibly user-friendly.

The site has been designed with the end-user in mind, ensuring that everything from placing trades to analyzing market data can be done seamlessly.

The menu options are clear and concise, and there are helpful tooltips throughout the site that provide additional information when needed.

What sets Rediff Money apart from other financial platforms is its commitment to simplicity without sacrificing functionality.

Unlike some cluttered interfaces out there, Rediff Money understands that users want an experience that is straightforward and easy to understand.

With intuitive icons and clear text labels, even those who are new to investing can quickly grasp how to use the platform effectively.

Overall, Rediff Money's sleek, intuitive, and user-friendly interface makes it a top choice for both experienced traders and beginners alike.

Portfolio Management: A comprehensive tool for tracking investments

Portfolio management is a crucial tool for investors looking to track and monitor their investments effectively.

Gone are the days of keeping spreadsheets or manually entering data, as portfolio management software offers a comprehensive solution that automates the process.

With features such as real-time tracking, performance analysis, risk assessment, and asset allocation modeling, investors can make informed decisions based on accurate and up-to-date information.

Furthermore, portfolio management software allows investors to diversify their holdings by providing insights into how different asset classes perform over time.

By analyzing historical data and market trends, investors can identify potential risks and opportunities for growth in their portfolios.

Additionally, these tools provide convenient ways to view the overall performance of an investment portfolio through visual representations such as charts and graphs.

This makes it easier for investors to assess their financial goals and make adjustments accordingly.

One of the key advantages of using portfolio management software is its ability to help investors keep track of multiple investment accounts in one centralized location.

Instead of logging into various platforms or contacting multiple brokers, users can simply access their portfolio management system to view all their investments at once.

This not only saves time but also enables better organization and oversight in managing different portfolios.

In conclusion, portfolio management software is a powerful tool that provides comprehensive tracking capabilities for investors.

From real-time monitoring to risk assessments and diversification strategies, this technology offers valuable insights that can aid decision-making processes when it comes to managing investments effectively.

By embracing this modern approach to managing portfolios, individuals can save time while maximizing returns on

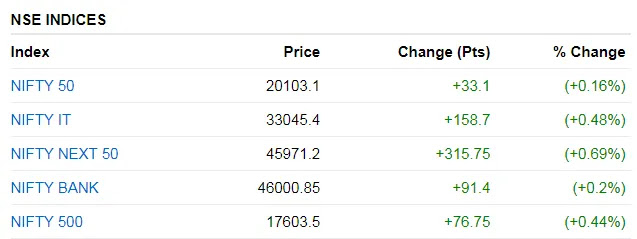

Market Analysis: Real-time data and expert insights

When it comes to making informed investment decisions, having access to real-time market data and expert insights is crucial.

Rediff Money offers a comprehensive suite of tools and resources that can help investors stay on top of market trends and make profitable trades.

With the ability to track stocks in real-time, analyze historical data, and receive alerts on price changes, users can make well-informed decisions based on up-to-the-minute information.

One standout feature of Rediff Money is its Market Analysis section which provides users with valuable insights from industry experts.

This section features exclusive articles, analysis, and commentary from experienced professionals who provide a unique perspective on the market.

By reading these thought-provoking pieces, investors can gain new insights into various sectors, understand macroeconomic trends affecting different industries, and identify potential opportunities for growth.

Furthermore, Rediff Money not only gives users access to expert opinions but also has a community forum where investors can discuss market trends with each other.

This allows for a collaborative approach to investing where individuals can bounce ideas off one another and get different perspectives before making their final decisions.

The platform fosters an engaging environment where seasoned traders share their strategies and newcomers learn from experts in the field.

In conclusion, Rediff Money's Market Analysis section offers a wealth of real-time data and expert insights that are essential for successful investing.

Whether you're a novice or an experienced investor looking for fresh perspectives, this platform provides all the necessary tools to stay ahead in the dynamic world of finance. With its intuitive interface

Trading Platform: Seamless execution and advanced features

When it comes to trading platforms, seamless execution and advanced features are the key factors that can make or break a trader's success.

Thankfully, Rediff Money has recognized this and developed a platform that ticks all the boxes.

With lightning-fast execution speeds and real-time data updates, traders can enter and exit positions with ease, maximizing their chances of profit.

But what sets Rediff Money apart from other trading platforms is its advanced features.

From customizable watchlists to intelligent alerts, the platform offers a range of tools that empower traders to make informed decisions.

The intuitive user interface makes it easy for even beginners to navigate through charts and analyze market trends.

Additionally, Rediff Money provides comprehensive reports on stocks, helping users stay informed about company news and updates.

With such seamless execution and advanced features at your fingertips, trading becomes not just a task but an opportunity for growth and success. Take advantage of Rediff Money's platform today and unlock your potential in the markets

Customer Support: Prompt and helpful assistance

One of the most crucial aspects of any online service is the customer support it provides.

In case of Rediff Money, their prompt and helpful assistance truly stands out.

From my personal experience, whenever I have encountered any issues or had questions about their services, their customer support team has always gone above and beyond to provide timely and effective solutions.

What sets Rediff Money apart from its competitors is not just the speed at which they respond, but also the level of expertise and understanding they bring to every interaction.

It's refreshing to know that when you reach out for help, you won't be met with automated responses or generic answers.

The team at Rediff Money takes the time to understand your specific concerns and goes out of their way to address them in a manner that leaves you feeling satisfied and valued as a customer.

Additionally, another noteworthy aspect of their customer support is that they don't just stop at resolving your immediate issue; they also take proactive measures to ensure you have a seamless experience moving forward.

Whether it's providing additional information or offering tips on how to optimize your use of their platform, Rediff Money excels in going the extra mile for its customers.

Overall, if there's one thing I can say about Rediff Money's customer support, it's that they truly care about providing prompt and helpful assistance tailored to each individual user’s needs.

This level of attention makes all the difference in building trust between users and a company—and ultimately leads me (and many others) to highly recommend Red

In conclusion, Rediff Money is truly a game-changer for investors.

The platform offers a wide range of features and tools that empower individuals to make informed investment decisions.

From real-time stock prices to comprehensive equity reports, Rediff Money caters to the needs of both novice and seasoned investors.

One of the standout features of Rediff Money is its ability to provide personalized investment advice based on users' portfolios and preferences.

Through advanced algorithms and data analysis, the platform identifies potential opportunities and suggests strategies for maximizing returns.

This level of customization sets Rediff Money apart from other financial platforms and provides users with a unique advantage in the market.

Furthermore, Rediff Money also offers valuable educational resources for those looking to enhance their understanding of investment principles and strategies.

With access to expert articles, tutorials, and webinars, users can continuously expand their knowledge base and stay updated on the latest market trends.

Overall, Rediff Money has revolutionized the way investors approach their financial journeys by providing them with an all-inclusive platform that combines information, insights, and personalized guidance.

Whether you're new to investing or an experienced trader, this game-changing tool will undoubtedly elevate your investment game to new heights.

So why wait? Dive into the world of Rediff Money today!

FAQs of Rediff Money Review

1. What is Rediff Money Review?

Rediff Money Review is a website that provides comprehensive reviews and analysis of various financial products, services, and investment opportunities.

2. How can Rediff Money Review help me make better financial decisions?

By providing unbiased reviews and expert analysis, Rediff Money Review helps you understand the pros and cons of different financial products, enabling you to make informed decisions that align with your financial goals.

3. Are the reviews on Rediff Money Review independent and impartial?

Yes, the reviews on Rediff Money Review are conducted by experienced professionals who maintain strict editorial independence to ensure unbiased and impartial information.

4. Can I trust the information provided on Rediff Money Review?

Absolutely! Rediff Money Review takes pride in offering accurate and up-to-date information. Our team thoroughly researches each topic before publishing any content.

5. Is there a charge for accessing the reviews on Rediff Money Review?

No, all the reviews on Rediff Money Review are available free of charge for our users' convenience.

6. Can I submit my own review or suggest a topic for review on Rediff Money Review?

Unfortunately, we do not accept user-submitted reviews or suggestions at this time. However, we value feedback from our readers and encourage you to reach out to us with any concerns or questions.

7. Does Rediff Money Review provide personalized financial advice?

While Rediff Money Review offers insightful information about various financial products, it is essential to consult with a qualified financial advisor for personalized advice tailored to your specific needs.

8. How often are new reviews published on Rediff Money Review?

New reviews are regularly published on our website as we strive to keep our readers updated with the latest market trends and opportunities in the finance industry.

Pros and Cons of Rediff Money Review

Pros:

1. Rediff Money Review provides comprehensive and updated financial news and analysis.

2. It offers a wide range of investment options, giving users access to various sectors and asset classes.

3. The platform provides real-time stock market updates, enabling users to make timely investment decisions.

4. Rediff Money Review offers personalized portfolio tracking, allowing users to monitor their investments in one place.

5. It provides educational resources and tools for beginners to understand the basics of investing.

Cons:

1. Some users have reported technical glitches and slow loading times on the Rediff Money Review platform.

2. The user interface may not be intuitive for all investors, especially those who are less experienced or unfamiliar with financial terminology.

3. There might be limited research reports available compared to other financial platforms, limiting in-depth analysis options for some users.

4. The website contains advertisements that can be distracting or intrusive during browsing sessions.

5. Customer support may not always be readily available or responsive when needed, causing delays or frustrations for some users seeking assistance.

Quotes About Rediff Money Review

Rediff Money Review: Where financial insights meet innovation and excitement.

Dive into the world of investments with Rediff Money Review, where they decode complex jargon into simple strategies.

Discover the power of informed decisions as Rediff Money Review empowers you to take control of your financial future.

Don't just settle for average returns, let Rediff Money Review guide you towards extraordinary opportunities in the market.