Discover the 5 secrets to make your money grow on Rediff Money! Get expert tips and strategies to maximize your investments today!

Welcome to the world of Rediff Money!, where your money has the potential to grow like never before.

If you're tired of your hard-earned cash sitting stagnant in your bank account, then it's time to unlock the secrets that will make it flourish.

In this article, we will reveal five tried and tested techniques that will not only help you increase your wealth but also pave a path towards financial freedom.

Get ready to embark on a journey filled with excitement and anticipation as we dive deep into the realm of money-making possibilities on Rediff Money!.

Why Rediff Money is the Key

Rediff Money is not just another financial platform; it is the key to unlocking the potential of your money.

With its user-friendly interface and comprehensive features, Rediff Money empowers you to take control of your finances like never before.

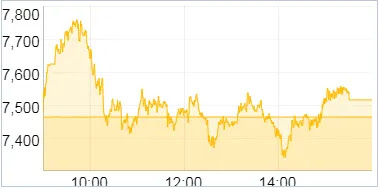

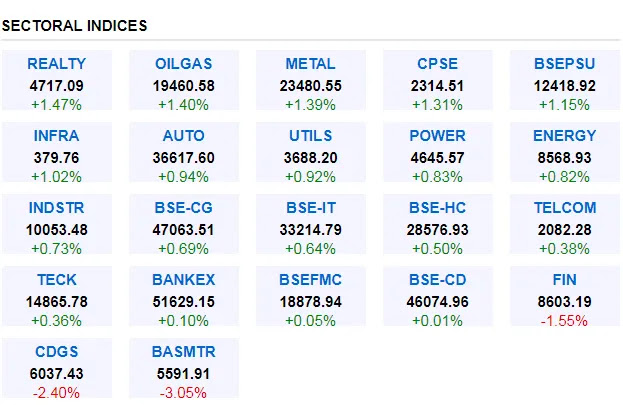

One of the secrets to making your money grow on Rediff Money lies in its real-time and customizable market data.

With access to live stock prices, indices, mutual funds, and more, you can stay ahead of the game and make informed investment decisions.

Additionally, Rediff Money provides insightful analysis and expert opinions on market trends and stocks, allowing you to tap into valuable insights that could significantly impact your portfolio's growth.

Another standout feature of Rediff Money is its robust portfolio management tool.

This tool enables you to effortlessly track the performance of your investments across various asset classes in a single dashboard.

It also provides insightful charts and graphs that help visualize the growth or decline of individual stocks or mutual funds over time.

By regularly monitoring your portfolios on Rediff Money, you can better understand which strategies are working for you and make adjustments as necessary.

In conclusion, if you want to take charge of your financial future and see real growth in your investments, then look no further than Rediff

Money. Its exceptional features such as real-time market data and portfolio management tools give you the edge needed to succeed in today's fast-paced financial landscape.

So why wait? Unlock the potential of your money with Rediff Money today!

Start Early: The Power of Compound Interest

When it comes to building wealth, one of the most powerful tools at your disposal is compound interest.

The concept behind compound interest is simple: you earn interest not only on your initial investment but also on any interest that accumulates over time.

This means that the earlier you start investing, the more time your money has to grow exponentially.

To truly harness the power of compound interest, it's essential to start early. Even small contributions made consistently over a long period can have a significant impact on your financial well-being.

Starting early allows you to take advantage of the compounding effect, where interest earns more interest and builds upon itself year after year.

The key here is time. The longer your money has to grow, the greater the potential for substantial returns.

By starting early and allowing your investments to compound over decades rather than mere years, you give yourself a head start in reaching financial independence and securing a comfortable retirement.

So don't wait - start investing as soon as possible! The power of compound interest can work wonders for your financial future if given enough time to do its magic.

Quotes

Compound interest is like a tree that grows stronger and taller with each passing year, nourished by the seeds of early investments.

Start early and watch your money bloom into a garden of financial abundance, thanks to the magic of compound interest.

Delaying your investment journey is like leaving a pot of gold on hold – don't miss out on the power of compound interest!

The earlier you start investing, the longer you get to bask in the sunshine of compounding returns – seize the opportunity!

Diversify Your Investments: Minimize Risks

One of the most effective ways to minimize risks in your investments is to diversify your portfolio.

Diversification involves spreading out your investment across different asset classes, industries, and geographical regions.

By doing so, you can reduce the impact of any single investment on your overall portfolio performance.

When one sector or market underperforms, another may be flourishing, and by having a diversified portfolio, you can benefit from these different trends.

For example, during times of economic downturn, traditional safe-haven assets like gold tend to perform well. However, in times of economic growth and stability, stocks may outperform other asset classes.

By holding a mix of both stocks and gold in your portfolio, you can protect yourself against market volatility and potentially increase returns.

Furthermore, diversifying beyond just stocks and gold is also crucial for risk reduction.

Including other asset classes such as bonds or real estate can provide additional stability during turbulent market conditions.

Bonds are generally less volatile than stocks and can serve as a cushion when stock markets experience volatility.

In conclusion, diversifying your investments is an essential strategy for minimizing risks.

By spreading out your investments across various assets and sectors, you can mitigate the impact of any single investment underperforming or experiencing loss.

Diversification allows you to take advantage of different opportunities that arise in different markets while protecting yourself against unforeseen events that may negatively affect one particular investment.

Ultimately it helps design a well-balanced portfolio capable of weathering storms and maximizing long-term growth potential.

Quotes

Don't put all your eggs in one basket; diversify your investments and watch your risks diminish.

Investing is like creating a colorful masterpiece; the more colors you use, the more vibrant and resilient it becomes.

A well-diversified portfolio is like a safety net that catches you when markets fall, ensuring your financial security remains intact.

Just as different spices enhance the flavor of a dish, diverse investments enhance the growth potential of your wealth.

Stay Informed: Keep Up with Market Trends

Staying informed about market trends is crucial for anyone looking to grow their money.

With the rapidly changing landscape of the financial markets, it's essential to keep up with the latest developments and make informed decisions.

By staying on top of market trends, you can identify new investment opportunities, spot potential risks, and take advantage of favorable conditions before they pass you by.

One great way to stay informed is by following reputable financial news sources.

Whether it's through online platforms, newspapers, or television channels dedicated to finance and business news, keeping up with the latest reports and analyses can give you valuable insights into what's happening in the markets.

Additionally, subscribing to newsletters from respected financial experts or joining online communities focused on investing can also provide fresh perspectives and valuable tips from experienced individuals.

Furthermore, don't be afraid to dig deep into data and research yourself. Exploring different investment strategies and analyzing historical data can give you a better understanding of how markets work and help you identify patterns that others may overlook.

Remember that while market trends are important guides for making investment decisions, they should never be your sole basis for action.

It's essential to conduct thorough due diligence and consider multiple factors before making any financial moves.

By staying informed about market trends through credible sources and conducting your own research, you can increase your chances of making smart investment choices that will ultimately grow your money over time.

Quotes

Stay informed about market trends, because the only constant in business is change.

Don't be a follower; be the trendsetter by staying updated on market shifts and adapting quickly.

Knowledge is power; investing time in understanding market trends will lead to smarter decisions and greater success.

The world moves fast, and so should your knowledge of market trends to thrive in an ever-changing business landscape.

Set Realistic Goals: Plan for the Future

Setting realistic financial goals is essential for long-term success and growth.

It's easy to get caught up in the excitement of big dreams and ambitions, but without a realistic plan in place, those aspirations can quickly become overwhelming and unattainable.

By taking the time to assess your current financial situation, identify your priorities, and set achievable goals, you'll be on the right track to securing a brighter future.

When setting financial goals, it's important to consider both short-term and long-term objectives.

Short-term goals help keep us motivated by providing tangible milestones that are within reach.

These could include things like paying off high-interest credit card debt or saving up for a vacation.

On the other hand, long-term goals require more planning and strategizing.

Whether it's saving for retirement or purchasing a new home, these objectives require patience and discipline.

Quotes

Don't be afraid to dream big, but make sure your goals are grounded in reality to ensure you're setting yourself up for success.

It's important to have a clear vision of where you want to go, but remember that the path may not always be linear or predictable - embrace the detours and learn from them.

Your goals should challenge and inspire you, but also allow room for flexibility and adaptation as life unfolds - it's about finding the balance between ambition and adaptability.

Setting realistic goals means recognizing your limitations and being kind to yourself along the way - celebrate progress, no matter how small, and keep moving forward.

Control Your Expenses: Save More, Invest More

One of the key secrets to making your money grow is to control your expenses. The more you are able to save, the more you have available to invest and generate greater returns.

Take a close look at where your money is going each month and identify areas where you can cut back.

This could mean eating out less often, finding cheaper alternatives for entertainment or transportation, or even renegotiating contracts and bills to get better deals.

By controlling your expenses, not only are you able to save more money, but you also become more mindful of your spending habits. This can translate into smarter financial decisions overall.

As you become more conscious of how every rupee is spent, you start thinking about long-term goals and value for money.

Instead of spending on impulse purchases that provide instant gratification but little lasting value, focus on investing in assets that will appreciate over time.

Remember that saving alone is not enough; investing is equally important in growing your wealth.

Once you have control over your expenses and have saved a significant amount, it’s time to put that money into investments that will yield higher returns than just keeping it in a savings account.

Explore different investment options such as stocks, mutual funds, real estate or even starting your own business. Diversify your portfolio so as to spread the risks and maximize opportunities for growth.

In conclusion, having control over our expenses enables us to save more money which in turn allows us to invest and grow our wealth further.

Quotes

Don't let your expenses control you; take charge and dictate where your money goes.

Investing in yourself is the best way to ensure a prosperous future, so prioritize saving and investing over unnecessary spending.

Instead of trying to keep up with the Joneses, focus on building your own financial empire by controlling your expenses and increasing your savings.

Every dollar you save today is a step closer to financial freedom tomorrow; control your expenses now to invest more in your dreams.

Conclusion: Grow Your Wealth with Rediff Money

In conclusion, Rediff Money is a powerful tool for anyone looking to grow their wealth.

With its diverse range of features and resources, it offers ample opportunities to make well-informed investment decisions.

One key aspect of using Rediff Money is staying updated with the latest market news and trends.

The platform provides real-time information on various asset classes, including stocks, mutual funds, commodities, and currencies.

By keeping a close eye on these updates and analyzing them carefully, users can identify potential investment opportunities before they become widely known.

Additionally, Rediff Money's portfolio management feature allows investors to track their holdings and monitor their performance in one convenient place.

This not only helps individuals stay organized but also enables them to make proactive adjustments to their portfolio based on market conditions or changing financial goals.

Overall, Rediff Money empowers users with the knowledge and tools needed to navigate the complex world of investments successfully.

By taking advantage of its features such as real-time market updates and portfolio management capabilities, individuals can maximize their chances of growing their wealth over time.

So why wait? Start your journey towards financial success today with Rediff Money!

FAQs

1. How can I start growing my money on Rediff Money?

To begin, create an account on Rediff Money and explore the various investment options available. Start by setting financial goals and develop a plan to achieve them.

2. What are some investment opportunities offered by Rediff Money?

Rediff Money provides a wide range of investment opportunities, including stocks, mutual funds, bonds, commodities, and real estate. You can choose the option that aligns with your financial goals and risk appetite.

3. Is it possible to make money quickly on Rediff Money?

While there is potential to make profits quickly in certain investments, it's important to understand that investing involves risks. It is advisable to have a long-term approach and seek professional advice before making any hasty decisions.

4. How can I stay updated with market trends on Rediff Money?

Rediff Money offers real-time updates on market trends through its news section and financial tools. By actively following these updates, you can make informed decisions regarding your investments.

5. Can beginners invest their money on Rediff Money?

Absolutely! Rediff Money caters to all levels of investors, including beginners. The platform offers educational resources such as articles, tutorials, and expert tips to help newcomers get started.

6. Does Rediff Money charge any fees for using their services?

Rediff Money does not charge any fees for creating an account or accessing its basic features. However, certain premium services may have associated charges which will be clearly mentioned.

7. Is my personal information safe while using Rediff Money?

Yes, rest assured that Rediff Money takes user data privacy seriously and employs industry-standard security measures to protect your personal information from unauthorized access.

8. How do I contact customer support if I encounter any issues while using Rediff Money?

If you need assistance or have any concerns while using the platform, you can reach out to the dedicated customer support team of Rediff Money through their contact details provided on the website. They are available to help you with any queries or technical difficulties.

Pros and Cons

Pros of Rediff Money!:

1. Provides a wide range of financial information and tools, including real-time stock quotes, market news, and analysis.

2. Offers a user-friendly interface that is easy to navigate and customize according to individual preferences.

3. Allows users to create personalized watchlists and portfolios for tracking investments.

4. Provides educational resources such as articles and tutorials to help users make informed financial decisions.

5. Offers seamless integration with Rediffmail and other Rediff services for a comprehensive online experience.

Cons of Rediff Money!:

1. The website can be overwhelming for beginners due to the abundance of information and tools available.

2. Some features may require additional charges or premium memberships, limiting access to certain functionalities.

3. Users have reported occasional technical glitches or slow loading times on the platform.

4. The quality and accuracy of market news and analysis provided by Rediff Money! may vary.

5. Limited customer support options are available, which can make it difficult for users to get timely assistance when needed.

Quotes

Invest in yourself, because the best return on investment is personal growth and knowledge.

Don't chase money, chase passion and purpose; success will follow effortlessly.

Financial literacy is not just about understanding numbers, it's about empowering yourself to make informed decisions that shape your future.

The stock market is a roller coaster ride, but don't let fear or greed be your driver; instead, let logic and analysis steer your financial journey.