Master the art of growing your crypto portfolio with proven strategies Short-term trading strategy focusing on intraday price movements. Medium-term strategy holding positions for days or weeks. Long-term investment strategy of buying and holding. Ultra-short-term trading for quick small profits. Automated trading using algorithms and bots. Profit from price differences across exchanges. Never invest more than you can afford to lose. Cryptocurrency trading carries significant risk. Past performance does not guarantee future results. Never risk more than 1-2% of your portfolio on a single trade. Calculate your position size based on your stop-loss distance. Always use stop-loss orders to limit potential losses. Set them at levels where your trade thesis is invalidated, typically 5-10% below entry for swing trades. Don't put all eggs in one basket. Spread investments across multiple cryptocurrencies and strategies to reduce overall portfolio risk. Target trades with at least a 2:1 reward-to-risk ratio. If risking $100, aim to profit at least $200. This allows for a winning strategy even with a 50% win rate. Stick to your trading plan. Avoid FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, Doubt). Take breaks after losses to avoid revenge trading. Use leverage sparingly or not at all. Leverage amplifies both gains and losses. Many traders have been liquidated using high leverage. The best time to learn about trading is when you're NOT trading. Study during market hours, then execute your plan calmly. Invest time in learning technical analysis, chart patterns, market psychology, and blockchain fundamentals. Knowledge is your best investment. Begin with small amounts while learning. Consider it tuition for your trading education. Scale up only when consistently profitable. Document every trade with entry/exit points, reasoning, emotions, and outcomes. Review regularly to identify patterns and improve. Stay updated on crypto news, regulations, partnerships, and technological developments. Use Twitter, Reddit, and reliable news sources. Invest fixed amounts regularly regardless of price. This reduces timing risk and emotional decision-making. Every losing trade is a lesson. Analyze what went wrong, adjust your strategy, and never repeat the same mistake twice. Practice strategies on demo or paper trading accounts before risking real money. Test until you achieve consistent results. Connect with experienced traders, share insights, and learn from others' experiences. Avoid pump-and-dump groups. Don't be greedy. Set profit targets and take some profits along the way. You can't go broke taking profits. Success in crypto trading comes with time and consistency. Avoid get-rich-quick schemes. Focus on steady, sustainable growth. Cryptocurrency markets are highly volatile and speculative. Only invest money you can afford to lose. This guide is for educational purposes only and should not be considered financial advice. Always do your own research (DYOR) and consider consulting with a financial advisor.📈 Crypto Trading Growth Guide

💰 Trading Profit Calculator

Your Trading Results

Profit/Loss

ROI

Final Value

Total Fees

📊 Compound Growth Calculator

Compound Growth Results

Final Balance

Total Gain

Growth Rate

🎯 Day Trading

📈 Swing Trading

💎 HODLing

⚡ Scalping

🤖 Bot Trading

📊 Arbitrage

⚠️ Risk Management Essentials

⚠️ Critical Warning

Key Risk Management Rules

1️⃣ Position Sizing

2️⃣ Stop-Loss Orders

3️⃣ Diversification

4️⃣ Risk-Reward Ratio

5️⃣ Emotional Control

6️⃣ Leverage Caution

💡 Essential Growth Tips

💡 Pro Tip

10 Ways to Grow Your Crypto Portfolio

1. Education First

2. Start Small

3. Keep a Trading Journal

4. Follow Market News

5. Dollar-Cost Averaging (DCA)

6. Learn from Mistakes

7. Use Demo Accounts

8. Join Trading Communities

9. Take Profits Regularly

10. Stay Patient and Disciplined

⚠️ Remember

Are you ready to embark on a thrilling and potentially lucrative journey into the world of cryptocurrency trading? Imagine turning a mere $100 investment into an impressive $10,000 in just a matter of time.

Sound like a fantasy? Well, it's not! With the right knowledge, strategy, and a dash of luck, you too can join the ranks of successful crypto traders who have transformed small investments into substantial profits.

In this article, we will guide you through the steps to grow your initial $100 investment into an astonishing $10,000 by harnessing the power of cryptocurrencies.

Important Disclaimer: Cryptocurrency trading involves significant risks, including the potential loss of your entire investment. This guide is for educational purposes only and is not financial advice. Markets are volatile, and past performance does not guarantee future results. Always do your own research (DYOR), consult professionals if needed, and only invest what you can afford to lose. Success requires discipline, patience, and luck – turning $100 into $10,000 is ambitious and not guaranteed.

Growing a small amount like $100 into $10,000 in crypto trading is challenging but possible in a bull market through compounding, smart strategies, and risk management. Based on strategies from experienced traders in 2025, here's a step-by-step plan. This assumes you're starting small and focuses on high-reward approaches like memecoins and blue-chip altcoins, while emphasizing education and caution.

Step 1: Educate Yourself and Set Up

Before trading, build knowledge to avoid common pitfalls.

- Learn the Basics: Understand blockchain, wallets, exchanges, technical analysis (TA), and fundamental analysis (FA). Free resources include YouTube channels, Medium articles, and X (Twitter) threads from reputable traders.

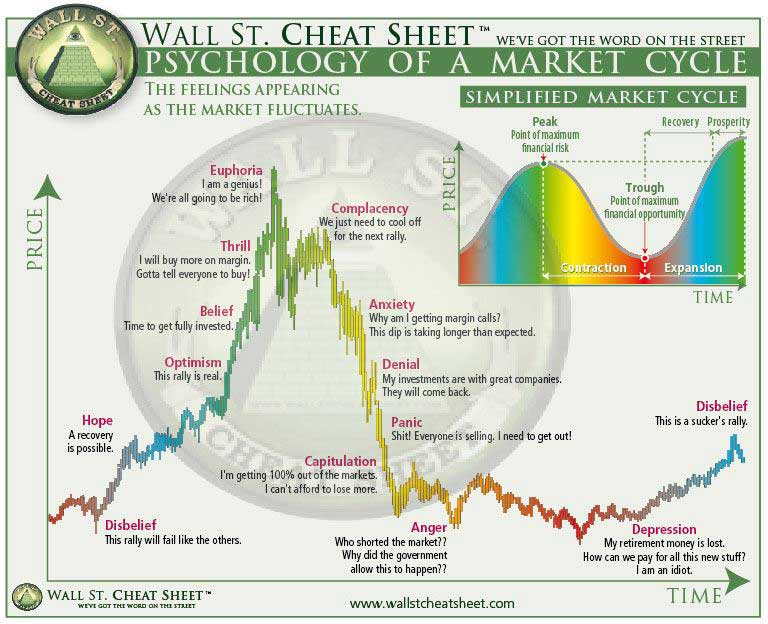

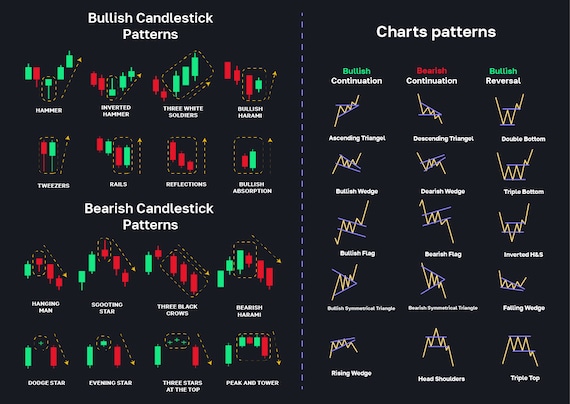

- Key Concepts: Study candlestick patterns, support/resistance, and market cycles.

(Example: Candlestick patterns for TA)

- Set Up Accounts: Use beginner-friendly exchanges like Binance, Bybit, or Coinbase. Enable 2FA for security. Start with a hardware wallet like Ledger for long-term holds.

- Budget Time: Dedicate time daily to research. Join communities on X, Discord, or Reddit for insights, but verify info.

- Get a Job or Side Hustle: For sustainability, ensure stable income to DCA without pressure.

Step 2: Develop a Strategy Based on Portfolio Size

Strategies vary by capital. For $100, focus on high-risk, high-reward plays to compound quickly, but cap risk.

Portfolio Allocation for $100 Start

From trader insights:

- 50% in Blue-Chip Altcoins: Buy established coins like ETH, SOL, ADA, LINK. Use Dollar-Cost Averaging (DCA) – invest fixed amounts regularly to average out volatility.

(DCA Example Chart)

- 20-30% in Memecoins or High-Risk Plays: On Solana (via Pump.fun or Raydium), hunt for early launches. Aim for 5-10x flips, but sell quickly. Educate on spotting rugs/scams.

- 20-30% in Stablecoins (e.g., USDC): Hold for buying dips or crashes.

- As You Grow: Once at $1K-$10K, sell 70% at 3x gains, ride the rest. Avoid over-leveraging.

| Portfolio Size | Strategy Focus | Risk Level | Exit Rule |

|---|---|---|---|

| Under $1K | 2-3x flips on memecoins; no moonbags | High | Sell all at target |

| $1K-$10K | 70% sell at 3x; ride rest | Medium-High | Rotate profits to blue-chips |

| $10K+ | Larger bets on established memes/altcoins; 3-5x max | Medium | Stable out, accumulate BTC/ETH |

Step 3: Risk Management – The Key to Survival

(Risk Management Infographic)

- Risk Only 1-2% Per Trade: On $100, risk $1-2 max. Use stop-losses to limit losses.

- Avoid Leverage Initially: Futures/perps can wipe you out; stick to spot trading.

- Diversify Sectors: Mix AI, DeFi, RWA projects (e.g., Solana ecosystem).

- Journal Trades: Track every entry/exit, why it worked, and improve.

- Emotional Control: Follow your plan; avoid FOMO. Use tools like TradingView for charts.

Step 4: Execution and Compounding

- DCA In: Buy weekly/monthly regardless of price.

- Take Profits: Sell in stages (e.g., 20% at 2x, 30% at 3x). Rotate into stables or better plays.

- Passive Income: Once at $1K+, stake ETH/SOL for yields (5-10% APY).

- Scale Up: As portfolio grows, reduce risk percentage. Aim for consistent 20-50% monthly returns through compounding (realistic in bull runs).

- Tools: Use bots for DCA (e.g., on Binance), alerts on DexScreener, and communities for alpha.

Step 5: Exit and Long-Term Planning

- Set Goals: Target milestones (e.g., $1K, then $5K). Cash out profits to bank as you hit them.

- Monitor Cycles: Crypto has bull/bear phases. Sell high, buy low.

(Market Cycles Chart)

- Taxes and Security: Track trades for taxes; use secure practices.

- When to Stop: If at $10K, diversify into stables/BTC for preservation.

Potential Timeline and Realism

In a 2025 bull market, compounding at 50% monthly could theoretically turn $100 into $10K in ~10 months, but this is optimistic. Real returns vary; many lose money. Focus on learning over quick riches.Understanding the potential of crypto trading

With the proliferation of cryptocurrencies, more and more people are exploring the potential of crypto trading.

However, understanding this potential goes beyond just chasing quick profits.

It requires a deep understanding of market trends, technological advancements, and risk management strategies.

One key aspect to consider is the volatility of cryptocurrencies. While this volatility can be seen as a challenge for some traders, it also presents incredible opportunities for profit generation.

By closely monitoring market movements and utilizing technical analysis tools, traders can identify patterns and trends that can inform their trading decisions.

Another important factor to understand is the impact of technological advancements on the crypto market.

As cryptocurrencies continue to gain mainstream adoption, new developments emerge constantly. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs), each innovation brings with it unique investment opportunities.

Keeping an eye on these developments can give traders an edge in identifying emerging trends and capitalizing on them.

In conclusion, understanding the potential of crypto trading goes beyond simply buying low and selling high.

It requires a holistic view that takes into account market volatility and technological advancements within the cryptocurrency ecosystem.

By staying informed about market trends and utilizing effective risk management strategies, traders stand a chance at growing their initial investments exponentially in this fast-paced and dynamic field.

Setting realistic goals and expectations

When it comes to trading crypto, setting realistic goals and expectations is crucial.

While it can be tempting to chase after massive gains and dream of transforming $100 into $10,000 overnight, the reality is often quite different.

It’s important to understand that crypto markets are highly volatile and unpredictable, making such rapid growth unlikely.

Instead of fixating on a specific dollar amount as your end goal, consider focusing on achievable milestones along the way.

For example, aim to increase your initial investment by a certain percentage each month or quarter.

This approach allows for more manageable expectations and reduces the risk of disappointment or frustration when the market doesn't meet your lofty dreams.

Remember that successful traders don't rely solely on luck or making a quick fortune; instead, they employ solid strategies and maintain discipline.

They understand that steady growth over time is possible but requires patience and smart decision-making.

By setting realistic goals based on sound research and analysis rather than wild aspirations, you increase your chances of long-term success in the volatile world of crypto trading.

Researching and analyzing different cryptocurrencies

Researching and analyzing different cryptocurrencies is an essential step in growing your investments in the crypto world.

With thousands of options available, it can be overwhelming to navigate the market.

However, taking the time to understand each cryptocurrency's fundamentals and analyze its potential can significantly increase your chances of success.

One key aspect of researching cryptocurrencies is examining their technology and utility.

Look for projects that solve real-world problems or improve upon existing systems.

For example, cryptocurrencies with strong use cases in sectors such as finance, healthcare, or supply chain management are worth exploring further.

Additionally, analyzing a cryptocurrency's team and community engagement can provide valuable insights into its future prospects.

A strong team with experience in relevant fields increases the likelihood of successful execution and growth.

Evaluating how active and engaged the project's community is also crucial since it indicates a passionate and supportive user base.

Remember that investing in cryptocurrencies involves risk, so conducting thorough research will help you make informed decisions about which ones to invest in.

By delving deeper into each cryptocurrency's technology, utility, team, and community engagement, you position yourself for greater success in navigating this complex yet rewarding market.

Developing a solid trading strategy

Developing a solid trading strategy is crucial for success in the cryptocurrency market.

It's important to have a clear plan of action that takes into account factors such as risk tolerance, time horizon, and specific goals.

A well-defined trading strategy helps to mitigate potential losses and maximize potential gains.

One aspect of developing a solid trading strategy is understanding the importance of emotional control.

Emotions can often cloud judgment and lead to impulsive decisions, which can be detrimental when it comes to trading cryptocurrencies.

By setting strict rules and parameters for buying and selling, traders can take emotions out of the equation and make more rational decisions based on market analysis.

Another key component of a solid trading strategy is diversification. Diversifying one's portfolio helps spread out risks across different assets, reducing the impact of any single investment going awry.

This can be achieved by investing in various cryptocurrencies or even expanding into other asset classes like stocks or commodities.

By diversifying effectively, traders can increase their chances of achieving consistent returns over time.

In conclusion, developing a solid trading strategy involves careful planning, emotional control, and diversification.

Taking the time to craft an effective strategy tailored to your individual circumstances will greatly increase your chances of growing your initial investment significantly in the volatile world of cryptocurrency trading.

Remember that consistency, discipline, and continuous evaluation are vital components for long-term success in this ever-evolving market.

Managing risk and setting stop-loss orders

One of the most important aspects of successful trading is managing risk.

Without a proper risk management strategy, you are essentially gambling with your hard-earned money. This is where setting stop-loss orders can be a game-changer.

A stop-loss order is a predetermined level at which you are willing to sell your investment in order to limit potential losses.

It acts as an insurance policy, protecting your capital in case the market moves against you.

By setting a stop-loss order, you ensure that if the price drops below a certain point, your position will be automatically sold, preventing further losses.

Setting the right stop-loss level requires careful consideration. It needs to be set at a point where it allows for normal market volatility while still protecting against major downside movements.

Some traders opt for a percentage-based approach, such as setting their stop-loss at 5% below their entry price.

Others prefer technical indicators or support and resistance levels to determine their stop-loss points.

Remember, setting a stop-loss order does not guarantee that you will avoid all losses; it simply helps limit them.

In fact, some traders argue that setting too tight of a stop loss can result in premature selling and missed opportunities for profits; finding the right balance is key.

Overall, managing risk and setting appropriate stop-loss orders should be an integral part of every trader's toolkit.

It helps protect against major losses and ensures that emotions do not drive trading decisions during periods of volatility or uncertainty.

Continuously learning and adapting to market trends

In the fast-paced world of cryptocurrency trading, market trends can change in the blink of an eye.

Staying ahead of the game requires continuous learning and adaptation to these ever-evolving trends.

Trading solely on past knowledge and strategies is a recipe for disaster.

Continuously educating yourself about new technologies, emerging markets, and regulatory changes is crucial for success in this highly volatile industry.

One way to stay on top of market trends is by actively participating in online communities and forums dedicated to cryptocurrency trading.

These platforms are a goldmine of information, where traders from all walks of life share insights, analysis, and predictions.

Engaging with others can expose you to different perspectives and help you identify potential opportunities or risks that may have otherwise gone unnoticed.

Moreover, it's important to regularly evaluate your own trading strategies and adapt them accordingly as market conditions change.

This means being open-minded and willing to adjust your approach based on new information or unexpected developments.

By continuously learning from your successes and failures, you can refine your strategies over time, increasing your chances of securing profitable trades.

Remember that while it's essential to stay informed about current market trends, blindly following every trend without critical analysis could lead you astray.

The key is finding a balance between being aware of what's happening in the market while maintaining a strategic approach based on thorough research and analysis.

Keep an eye out for indicators that align with your overall investment strategy or take inspiration from successful traders but always apply deep thinking before making any decisions.

Conclusion: The path to growing your investment.

In conclusion, growing your investment in the world of crypto requires a combination of knowledge, experience, and a strategic approach. One key aspect to consider is diversification.

Spreading your investments across different cryptocurrencies can help reduce risk and maximize potential gains.

By selecting promising projects and keeping up with market trends, you can seize opportunities for growth.

Additionally, staying informed about the latest news and developments in the crypto industry is vital.

This includes monitoring regulatory changes, technological advancements, and project updates.

Being proactive in understanding market dynamics will allow you to make better-informed decisions.

Lastly, it's important to have a long-term vision when investing in cryptocurrencies.

The market can be highly volatile and subject to short-term fluctuations.

Therefore, having patience and being willing to ride out temporary dips will increase your chances of overall success.

By following these strategies while constantly fine-tuning your approach based on your own experiences, you can pave the path towards growing an initial investment of $100 into a substantial $10,000 through trading cryptocurrency.

Remember that success doesn't happen overnight but by putting in the effort and staying committed to learning and adapting as needed, you'll be well on your way to financial growth in the exciting world of crypto trading!

FAQs:

1. Can I really grow my $100 investment to $10,000 trading crypto?

Absolutely! With the right strategies and market knowledge, it is definitely possible to achieve such remarkable growth in the crypto trading world.

2. How do I get started with trading crypto if I have no experience?

You can start by educating yourself about cryptocurrencies, understanding market trends, and learning technical analysis. It's also beneficial to practice with a virtual trading account before investing real money.

3. What are some important factors to consider before making a trade?

Some key factors include analyzing the coin's fundamentals, studying its price history and market sentiment, keeping track of news and events that could impact the market, and setting clear entry and exit points.

4. Is it necessary to constantly monitor the market while trading crypto?

While active monitoring is beneficial for day traders, it's not always necessary for long-term investors. However, staying updated with industry news and major developments is crucial for making informed decisions.

5. How can I minimize potential losses while trading crypto?

Implementing risk management techniques like setting stop-loss orders or diversifying your portfolio can help limit potential losses. Additionally, never invest more than you can afford to lose.

6. Are there any specific strategies that work well in the crypto market?

There are various strategies you can explore such as trend following, swing trading, or even participating in initial coin offerings (ICOs). The key is finding a strategy that aligns with your goals and risk tolerance.

7. Should I rely solely on technical analysis when making trading decisions?

While technical analysis plays an important role in predicting price movements, it should not be the sole factor driving your decisions. Combining fundamental analysis with technical indicators can provide a more comprehensive view.

8. What are some common mistakes to avoid while trading crypto?

Avoid emotional decision-making based on fear or greed, overtrading without proper research or planning, falling for scams or pump-and-dump schemes, and investing without understanding the underlying technology of a coin.

Pros and Cons

Pros:

1. High potential for significant profits: Trading crypto can offer the opportunity to achieve substantial returns on your initial investment.

2. Accessible to beginners: With numerous educational resources available online, it is possible for individuals with limited experience to learn and participate in crypto trading.

3. 24/7 market availability: Unlike traditional stock markets, the cryptocurrency market operates around-the-clock, providing flexibility to traders from different time zones.

4. Diverse range of cryptocurrencies: The crypto market offers a wide selection of coins and tokens, allowing traders to diversify their portfolio and potentially reduce risk.

5. Possibility of passive income: Through strategies like staking or lending, crypto traders may be able to earn additional income by holding certain cryptocurrencies.

Cons:

1. High volatility and risk: The cryptocurrency market is known for its extreme price fluctuations, which can lead to substantial losses if not managed properly.

2. Market manipulation and scams: Due to limited regulations and oversight in some jurisdictions, there is a higher risk of encountering fraudulent schemes or manipulative practices in the crypto industry.

3. Technical complexity: Understanding the intricacies of blockchain technology and navigating various exchanges can be challenging for inexperienced traders.

4. Emotional stress: Constantly monitoring the market and making trading

:max_bytes(150000):strip_icc()/Dollar-Cost-Averaging-DCA-f79fcd89eaa34bb7adad3dacc3129798.png)