- Learn to read crypto charts like a pro. This guide will teach you how to trade cryptocurrencies.

- Learn how to read crypto charts and make a profit from them.

- Learn how to read crypto charts and technical analysis.

Cryptocurrencies are a new and exciting investment opportunity, but they can be difficult to understand. One of the most important aspects of investing in cryptos is learning how to read crypto charts.

In this article, we will introduce you to the basics of reading crypto charts and provide some tips on how to get started.

What is a crypto chart?

|

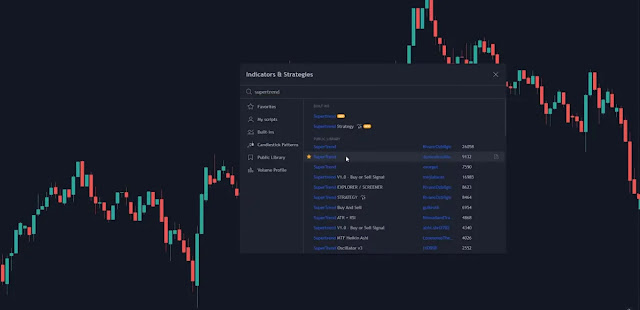

| Resource Tradingview |

|

| Resource Tradingview |

Cryptocurrency charts are a visual representation of the price fluctuations of different digital currencies over time.

They can be used to track the performance of a particular cryptocurrency or to compare the performance of different cryptocurrencies.

Cryptocurrency charts are usually displayed as line graphs, which show the price of a currency over time. The x-axis on a line graph represents time, while the y-axis represents the price of the currency.

How to read and interpret a crypto chart

- "Reading crypto charts is like deciphering a secret language, but once you crack the code, the possibilities are endless."

- "Just like understanding the ebb and flow of the tide, grasping crypto charts allows you to ride the waves of opportunity in the market."

- Don't let fear cloud your judgment when reading crypto charts; instead, let curiosity guide you towards discovering hidden patterns and trends.

- "Reading crypto charts is not just about numbers and lines; it's about unraveling a story that can lead to financial freedom."

Cryptocurrencies are complicated and there is a lot of information available to help you understand them. This guide will teach you how to read a crypto chart and interpret the data.

- First, you need to know what a crypto chart is. A crypto chart is simply a graphical representation of cryptocurrency prices over time. It can be used to track trends, measure market movements, and predict future price action.

- Second, you need to understand how to read a crypto chart. The first thing you need to do is identify the trend.

If you see a pattern of increasing or decreasing prices over time, then that's likely an indication of a trend. Next, you need to look at the height of the bars in the graph.

The taller the bar, the more money was raised or lost during that time period. Finally, pay attention to how closely the prices are tracking each other.

Don't invest in crypto unless you know how to read the charts

- "Don't dive into the crypto world blindly; learn to decipher the charts before you make a splash."

- "Chart reading is like finding hidden treasures in the vast ocean of cryptocurrencies; equip yourself with this skill and ride the waves of success."

- "Investing in crypto without understanding charts is like navigating an unfamiliar road without a map; don't let ignorance drive your financial journey."

- "Charts are the compasses that guide wise investors through the volatile tides of cryptocurrency; master their language to steer your wealth towards new horizons."

In order to make money in the crypto world, you need to do more than just invest. You also need to be able to read charts in order to understand when the right time to buy or sell is.

Many people invest blindly, not understanding what they're buying or why the price is going up or down. If you're not comfortable with reading charts, it's best to stay away from cryptos altogether until you've learned more about them.

Here's how to find trends in crypto charts

In order to make money in the cryptocurrency market, it is necessary to ride the waves of trends.

Here we discuss how to find and analyze trends in cryptocurrency charts.

A trend can be defined as a general direction in which a security or market is moving. The goal is to identify when a trend has started when it is mature, and when it might be ending.

How to predict price movements with technical analysis

"Mastering technical analysis is like deciphering the language of the market, enabling you to predict price movements with finesse and precision." "In a world of chaos and uncertainty, technical analysis serves as our compass, guiding us through the turbulent waters of price fluctuations." "The art of predicting price movements lies not in crystal ball gazing, but in understanding the intricate patterns and signals that unveil the hidden secrets of the market." "Technical analysis is an orchestra where each indicator and chart pattern plays its unique note, harmoniously creating a symphony of profitable predictions."

Technical analysis is the study of past price movements to predict future price movements. There are many different technical analysis tools and indicators, but all technical analysis indicators fall into one of two categories: trend indicators or momentum indicators.

Trend indicators help you identify the current trend and determine when it is likely to end. Momentum indicators help you determine whether the current trend is gaining or losing steam.

There is no one indicator that can predict price movements with 100% accuracy, but using a combination of trend and momentum indicators can give you a good idea of where the market is heading.

The basics of reading crypto charts

Cryptocurrency prices are often displayed in charts, which allow investors to track price movements and trends.

In order to read crypto charts effectively, it is important to understand the various components that make up a chart and what each of these components represents. Commodity:

The cryptocurrency market is made up of thousands of different digital tokens. Each token represents a certain value of a certain commodity, such as gold, silver, or oil. Different cryptocurrencies are created to represent different commodities.

Analyzing charts for trends

When analyzing charts for trends, it is important to consider all of the factors that may be influencing the data.

It is also important to have a good understanding of what the data represents and how it is collected.

By taking all of this into account, you can get a better idea of whether or not the trend you are seeing is real, and what its potential implications may be.

Spotting opportunities with charts

In today's world, it is important to be able to spot opportunities.

One way to do this is by using charts. Charts can help you see patterns and trends that you may not have otherwise noticed.

They can also help you make decisions about what investments to make or which products to sell.

What are some common crypto chart patterns?

- "Charts are like roadmaps to the crypto world, showing us where we've been and guiding us where we're going."

- "Don't be fooled by the simplicity of a chart pattern; behind its lines and shapes lies a wealth of information waiting to be unraveled."

- "In the world of crypto chart patterns, there's no room for complacency - what may seem familiar today could lead to unexpected surprises tomorrow."

- "In the world of crypto chart patterns, there's no room for complacency - what may seem familiar today could lead to unexpected surprises tomorrow."

Cryptocurrencies are often traded on various digital exchanges and can be volatile.

As such, charts can be used to identify patterns in price movement over time. Here are some common crypto chart patterns:

The Parabolic SAR (Slow accumulation rate over a long period of time followed by an explosive price increase).

The Double Bottom or Wipeout (A steep decline in price followed by a sudden reversal, triggering a sell-off).

The Head and Shoulders Pattern (A symmetrical triangle that forms after a market has been trending upward for some time).

The Crab Pattern (A formation consisting of two parallel lines with the bottom line higher than the top line, indicating downward momentum).

How can you spot a crypto reversal pattern?

Cryptocurrencies are known for their volatility and price swings. While this may be exciting for some traders, it can also be nerve-wracking and lead to losses for others.

In order to maximize profits and minimize losses, it is important to be able to spot reversal patterns.

In this article, we will discuss how to spot a crypto reversal pattern and what factors you should consider when trading cryptocurrencies.

The bearish reversal patterns are very simple to spot. If a cryptocurrency reverses from an upward trend, it will form a Bearish Head and Shoulders pattern.

The bearish head and shoulders pattern occurs if the cryptocurrency has made a significant downward reversal. It will often form a consolidation pattern, with the price making several lower highs and lows before forming the trend-line support.

How to spot reversals in the market

The market is a complex system that can be difficult to predict. Prices can move in any direction, and it's often hard to tell when a reversal is happening. In this article, we'll discuss how to spot reversals in the market and take advantage of them.

- First, we'll look at what reversals are and how they form. Then, we'll discuss some indicators that can help you spot reversals in the market.

- Finally, we'll give some tips on how to trade reversals effectively.

What is a crypto chart and how can it be useful?

Crypto charts are a tool that can be used to analyze and track the price of cryptocurrencies.

They allow investors to see how a particular cryptocurrency is performing over time and can help them make informed decisions about whether or not to invest in a particular coin.

Crypto charts provide investors with a visual representation of data and can help them make better decisions about how to invest.

Crypto charts are a popular tool for traders and investors, who use them to determine if their investments are making money or losing it.

What are the best Cryptocurrency Trading Strategies?

There is no definitive answer to this question. Different traders will have different opinions, and what works for one trader may not work for another.

However, there are a few basic strategies that all traders should be aware of.

- One strategy is to buy low and sell high. This means buying Cryptocurrencies when they are cheap and selling them when they are expensive.

- A second strategy is to hold Cryptocurrencies for the long term. This involves buying them and holding onto them until they increase in value.

- A third strategy is to trade Cryptocurrencies on margin. This involves borrowing money from a broker in order to purchase more Cryptocurrencies.

- Finally, some traders use technical analysis tools to make trading decisions. These tools can include things like chart patterns, moving averages, and RSI indicators.

How to make money with Crypto

- "Investing in crypto is like surfing the waves of uncertainty, but those who dare to ride them with a strategic approach are the ones who catch the biggest profits."

- "Instead of chasing quick gains, focus on understanding the technology behind crypto and invest in projects that have a real-world impact. That's where true wealth lies."

- "Crypto is not just about making money; it's about participating in a revolution that challenges traditional financial systems. Embrace the change and let your financial freedom unleash."

- "Don't be afraid to take calculated risks when it comes to crypto investments. Just remember, fortune favors the bold, but wisdom ensures sustainable prosperity."

Cryptocurrencies are not a get-rich-quick scheme. If you want to make money with Crypto, then you need to have a good grasp of how the market works.

Begin by understanding how the market works. This involves reading articles and watching videos that explain how the market works. Next, you need to understand what Cryptocurrencies are trying to solve.

One of the first things you should learn is Bitcoin’s history. You can do so on the blockchain. ICO bitcoin value Cryptocurrencies are no different than any other type of investment.

This means that it is important to do your research before making any investments. Take time to read about different cryptocurrencies and the blockchain technology they are built on.

The most important thing to understand about cryptocurrencies is that they are decentralized.

This means that no single person or organization controls the entire system. Instead, all Cryptocurrencies run on independent blockchains.

A crypto chart is a visual representation of price changes over time for digital currencies

A crypto chart is a visual representation of price changes over time for digital currencies. The y-axis typically represents the price of the cryptocurrency in USD, while the x-axis shows time in increments such as days, weeks, or months.

Crypto charts can be helpful for analyzing price trends and determining when to buy or sell a particular cryptocurrency.

They can help you determine when to buy or sell cryptocurrencies

In recent years, cryptocurrencies have become increasingly popular. Many people invest in them because they believe that they will make a lot of money. However, it can be difficult to determine when to buy or sell cryptocurrencies.

Fortunately, there are some tools that can help you do this. One of these tools is the CoinMarketCap website.

This website provides information about the price and market capitalization of various cryptocurrencies. It also provides a list of the top 100 cryptocurrencies by market cap. Another tool is the Cryptocompare website.

This website provides information about the prices of various cryptocurrencies on different exchanges. It also provides a list of the top 50 cryptocurrencies by volume.

These websites can help you determine when to buy or sell cryptocurrencies.

By tracking charts, you can make more informed investment decisions

In today's economy, it is more important than ever to be able to make informed investment decisions.

By tracking stock charts, you can spot patterns and trends that will help you make more informed choices about where to invest your money.

By keeping an eye on the market, you can avoid making costly mistakes that could damage your financial future. It is important to keep up with the news in order to be aware of what is happening in the market.

You can use any of the websites mentioned above to keep up with the latest news. A good way to start doing this is by checking out any cryptocurrency news websites.

What are the different types of charts that are used in cryptos?

Cryptocurrency charts are used to track the performance of a digital asset over time. There are many different types of cryptocurrency charts, and each one has its own unique features.

Here are some of the most common types of cryptocurrency charts:

1. Price chart: This is the most common type of cryptocurrency chart, and it shows how prices have changed over time.

2. Volume chart: This chart shows how much money is being traded for a given digital asset over time.

3. Support and resistance levels: These are important indicators for traders, and they show where buyers and sellers are likely to congregate.

4. Moving averages: A moving average is a mathematical formula that helps smooth out fluctuations in price data. It's often used as an indicator of long-term trends in a market.

5 . Harmonic oscillator This chart gives an indication of the strength of a trend by showing how closely prices are moving to a series of points plotted on the chart.

6. Candlesticks These show when and where an asset has traded and what its price was at that point in time.

What Lies Ahead for Cryptocurrency Charts

Bitcoin, the first and most well-known cryptocurrency, has seen a meteoric rise in value since its inception in 2009.

With a market capitalization of over $137 billion as of January 2018, it is by far the most valuable cryptocurrency on the market. Bitcoin's value comes from its ability to be used as both a store of value and a medium of exchange.

As bitcoin's price increases, interest in other cryptocurrencies also rises. In 2017, the total market capitalization for all cryptocurrencies surpassed $600 billion.

This growth was largely driven by investors looking to capitalize on the high returns that many of these currencies offer.

However, the high volatility of cryptocurrency prices means that they are often subject to sharp price movements. As a result, investing in cryptocurrencies can be risky and should only be done by those who are aware of the risks involved.

Simple But Effective Ways to Use Technical Analysis for Cryptocurrencies

In the cryptocurrency world, there are a variety of ways to analyze the markets. Technical analysis is one of the simplest and most effective methods.

This article will discuss some of the basic principles of technical analysis and how they can be applied to cryptocurrencies.

Technical analysis is a method of predicting future prices by analyzing past price movements.

It relies on the assumption that history will repeat itself, and that patterns in price movements will continue to occur.

There are a number of different technical analysis indicators, but some of the most popular include moving averages, Bollinger bands, and the Relative Strength Index (RSI).

One of the benefits of technical analysis is that it can be used to identify buying and selling opportunities. When used correctly, it can help traders make more informed decisions about when to buy or sell cryptocurrencies.

How to read crypto charts?

Crypto charts are visual representations of the price of cryptocurrencies over time. They can be represented as line charts, candlestick charts, or time-series charts.

Crypto charts are a great way for investors to gain a better understanding of how the price of a cryptocurrency changes over time.

The best part about reading crypto charts is that they can be easily created in any cryptocurrency charting software package available.

There are several steps you will need to follow in order to read a crypto chart. Let’s start with the basics:

Step 1: Understand what is a cryptocurrency and what is an ICO? Before you can get started with cryptocurrency charting, you will need to understand what a cryptocurrency and an ICO are first.

These are two terms that we hear a lot in the crypto world, but most people don’t really know what they mean.

A cryptocurrency is a digital currency that uses cryptography to secure transactions and control the creation of new units.

Just like traditional fiat money, cryptocurrencies are not backed by any precious metals or hard assets.

ICO (Initial Coin Offering) is a type of fundraising mechanism where companies can raise large amounts of money by offering digital tokens to investors in exchange for fiat currency.

While ICOs are still relatively new and unregulated, they have grown in popularity since the start of 2018.

As cryptocurrency prices continue to increase and more investors become interested in entering the market, there will be more ICOs being launched.

One of the main reasons that ICOs are attractive to investors is because they offer the possibility of earning a high return on investment.

As with any investment, there are a number of risks involved in participating in an ICO. Below is a list of key factors to consider: The process of investing in an ICO is similar to that of buying shares in a company. The steps involved include:

To invest in an ICO, you need to be able to purchase cryptocurrency. This can be done by registering with one of the several cryptocurrency exchanges.

Step 2 - You need to deposit funds into your chosen cryptocurrency exchange. In this instance, we will use Binance as our example. Binance is an exchange that has a wide range of cryptocurrencies available to trade, including the popular Bitcoin and Ethereum.

Step 3 - You need to purchase the cryptocurrency of your choice. In this instance make sure to use Bitcoin as it is one of the most popular cryptocurrencies used in ICOs.

Step 4 - You will now have to transfer the funds you have deposited into your Binance account.

In order to trade cryptocurrencies, one needs to understand how to read crypto charts.

How to read crypto charts for beginners?

Cryptocurrency charts can be confusing for beginners. In this article, we will discuss how to read crypto charts and what to look for when doing so.

The first step is to understand the basics of candlestick charts.

Candlesticks are a type of chart used to track the price movements of a security over time.

Each candlestick represents the opening, high, low, and closing prices of the security for a given time period.

The color of the candlestick can indicate whether the security closed higher or lower than it opened. Next, we will discuss how to interpret these signals.

In general, you want to look for bullish signals when buying and bearish signals when selling.

A bullish signal is typically indicated by a green candlestick and a bearish signal is typically indicated by a red candlestick.

What are the most important things to look for when reading crypto charts?

Cryptocurrency charts are used to track the price of cryptocurrencies over time. The most important thing to look for when reading crypto charts is the trend.

The trend can indicate whether the price of a cryptocurrency is going up or down and can help you make trading decisions.

You should also pay attention to volume, which indicates how much money is being traded for a particular cryptocurrency.

Chart patterns can also give you clues about where the price of a cryptocurrency is headed.

What is a candlestick chart?

A candlestick chart is a type of price chart that displays the high, low, opening, and closing prices of a security or investment. How are crypto candlesticks different from traditional ones?

In the traditional version of a candlestick chart, there were two types of candles.

- The first one is the open and close, which represents the highest and lowest price in a particular period.

- The second type of candlestick is the real body, which is the middle part of a candle. Here, you can see the range and volume of buying and selling in the market.

What is a candlestick chart and how can you use it to predict stock prices?

Candlestick charts are a popular way to predict stock prices. Candlestick charts show the changes in price over time for given security. The most common type of candlestick chart is the open, high, low, and close (OHLC) chart.

You can use this information to develop trading strategies.

The OHLC chart shows the open, high, low, and close prices for the stock. It is formatted in a circle with a black background. At the top of the chart, you will see a thin line that represents the opening price. The thin line represents the first trading day of the stock.

The next day, you will see a thicker line which is the high price. That is the day the stock opened at its highest price. The next day, a thinner line appears that represents the lowest price.

How do I read a candlestick chart?

A candlestick chart is a visual representation of price movements over time.

The body of the candle shows the opening and closing prices, while the wick shows the high and low prices.

Candlesticks can be used to identify trend reversals and momentum changes.

The body of the candle represents the range of the stock's daily price movements. The wick, or line, shows the highest and lowest prices on that day.

The wick's length represents the extent of major price movement.

The length of the body is determined by whether the stock opened or closed higher or lower than its opening price. Candlesticks can be used to identify trend reversals and momentum changes.

How do candlestick charts differ from other types of charts?

Candlestick charts are a type of technical analysis that is often used to predict future stock prices.

They differ from other types of charts in that they use a series of dots to represent the price of a stock over time.

Candlestick charts are commonly used by traders and investors to analyze trends and evaluate market conditions.

Candlestick charts are also referred to as candlestick charts because of the three lines that make up the chart. The lines represent high, low and closing prices for each day.

What are some candlestick patterns?

|

| Source: Crypto.com |

There are several candlestick patterns that can be used to analyze a stock’s price action.

Trading the candlestick pattern is similar to trading a stock chart, with the exception that there are three lines and no spaces between them.

Each line represents a specific period in time. The Three-Line Pattern The three-line pattern is used to indicate a new trend has emerged.

A bullish candlestick pattern consists of three lines: The small body, the upper wick, and the larger body. The small body represents the opening price in the time period.

The wick represents the high price of the period. The larger body represents the low price of the period.

A bearish pattern is characterized by three lines: a small body, an upper wick, and a lower body.

What is an uptrend?

An uptrend is a pattern observed in price data where the trendline slopes upwards. It is considered to be the indicator that signals a reversal of trends.

It is believed that an uptrend will continue until it reaches its highest point, which is known as a peak.

How do you spot an uptrend?

Up trends are a popular topic of discussion in the market. Many people believe that they can see the signs of an uptrend early on and make money by buying in before the trend reverses.

However, there is no one definitive way to spot an uptrend.

Some indicators that might suggest an uptrend include increasing prices, more buyers than sellers, and increased volume.

It is important to take into account all of the factors that could be influencing the stock price when making a decision to buy or sell.

What signals indicate that a stock is in an uptrend?

When looking at a stock chart, there are a few key indicators that can help you determine if the stock is in an uptrend.

The first is the price trend. In an uptrend, the stock price will consistently make higher highs and higher lows.

This can be seen by looking at a line chart or a candlestick chart.

Another indicator is the relative strength index (RSI). The RSI measures how strong the current price move is, compared to how strong the stock has been moving in the past.

A high RSI reading means that the stock is moving strongly and may be overbought. A low RSI reading means that the stock may be getting oversold and could be due for a rebound.

The third indicator is volume. In an uptrend, the volume should be increasing as the stock moves higher.

How can you use moving averages to help identify an uptrend?

Moving averages are one of the most commonly used technical indicators. They are simple to understand and can be used to identify an uptrend or downtrend in a security's price.

There are three types of moving averages - simple, weighted, and exponential - each with its own calculation method.

The most popular type is the simple moving average, which is computed by taking the sum of the closing prices over a given number of periods and then dividing it by the number of periods.

A moving average can be used to identify an uptrend by looking for a series of higher highs and higher lows on the graph.

5 signs you're in an uptrend

An uptrend is a market condition in which the prices of assets are increasing.

The five signs that you're in an uptrend are:

1) prices are making higher highs and higher lows;

2) there is an increase in volume on up days;

3) the trendline is sloping upwards;

4) there are more advancing stocks than declining stocks;

5) MACD is positive.

How to stay safe in an uptrend

An uptrend is a market condition in which prices are rising. It can be a great time to make money if you know how to stay safe. Here are some tips for staying safe in an uptrend:

1. Stay disciplined and patient. Don't get caught up in the excitement of the rally and start making careless trades. Wait for good opportunities and stick to your plan.

2. Use stop losses. This is one of the most important things you can do to protect your profits. Place stop losses on all your positions so that if the market starts to move against you, you'll get out at a loss instead of losing more money later.

3. Keep your position size small. This will help you stay flexible and reduce your risk if the market moves against you.

4. Avoid overexposing yourself to risk.

What are the characteristics of an uptrend?

Trends can be tricky to identify, but there are certain characteristics that generally identify an uptrend. Uptrends often start with a small increase in activity, followed by a larger increase.

They may continue for a period of time before eventually reversing. Finally, they tend to occur in markets with high volumes and high volatility

What causes uptrends

There are a variety of reasons that can cause an uptrend in the stock market.

Some reasons could include a positive earnings report, increased demand for the company's products or services, or news that the company is being acquired.

Other factors that could lead to an uptrend include interest rate cuts by the Federal Reserve, a weak U.S. dollar, or good economic news.

An uptrend is a rise in the price of a security or index over time

An uptrend is when the price of a security or index rises over time. A trend can be identified by observing whether the price is moving up or down.

When the price rises over a period of time, this is called an uptrend. In technical analysis, an uptrend is a sustained rise in the price of a security or index over time.

How to take advantage of an uptrend

No one can predict the future of the markets, but there are ways to take advantage of an uptrend when it happens.

Here are four tips to follow:

1. Find stocks that are in an uptrend. There are a few ways to do this. You can use technical analysis tools like moving averages or trendlines to help you identify stocks that are trending higher. You can also use fundamental analysis to find companies with strong earnings and fundamentals that may be headed for a price increase.

2. Buy stocks when they are trading at a discount. One way to maximize your profits is to buy stocks when they are trading at a discount relative to their 52-week high. This means you can buy them when they are cheaper than they have been in the past and sell them when they reach their 52-week high.

3 . Buy stocks that are trading below their 52-week low. There are a few ways to do this. You can use technical analysis tools like moving averages or trendlines to help you identify stocks that are trending lower.

4 . Buy stocks when they have broken out of An uptrend is a price movement that has been gradually rising for a period of time. Once it reaches a certain point, a stock usually starts to break out of the prior trend and head in another direction.

What do uptrends mean for investors?

Investors typically pay close attention to stock market trends. When a trend is up, it usually indicates that the market is bullish on a particular stock or sector.

This can be good news for investors who have money invested in stocks that are riding the uptrend. Conversely, when a trend turns downward,

it can be a sign that the market is no longer bullish on a particular security or sector, and investors may want to consider selling their holdings.

How to identify and trade an up

There are a few things you can do to identify an uptrend. One is to look at the trend lines in the price charts.

If the price is moving higher along a linear trend, that's considered an uptrend.

You can also monitor news and events that might impact the market.

If there's something that could cause investors to buy more stocks, for example, that's likely to cause the market to go up.

The three characteristics of an uptrend are: A trendline, higher highs, and higher lows

Trendlines are a common indicator of an uptrend. They connect higher highs and higher lows, indicating that prices are moving upward. Uptrends can continue for a long time if the trendline holds.

Other signs of an uptrend include more buying activity and positive feedback loops. When these three characteristics are present, it’s usually safe to invest in stock prices.

If you don t see the three characteristics, it s probably time to begin selling. If a trendline is not present, the stock price might be in a downtrend.

What is a downtrend?

One way to track the value of cryptocurrencies is by looking at charts. Charts allow you to visualize the price movement of a cryptocurrency over a period of time.

A downtrend is a pattern observed in price data where

The purpose of this guide is to help readers understand how to read crypto charts.

A downtrend is a pattern observed in price data where each successive low is lower than the previous low.

The opposite of a downtrend is an uptrend, which is a pattern where each successive high is higher than the previous high.

In order to identify these patterns, it is necessary to first understand what candles and indicators are.

A candle is a line plotted on a chart that shows the opening and closing prices of a particular trade period. Candles are usually colored blue but can be any color.

Candles are graphical representations of price data over a specific time frame.

The 5 signs that you're in a downtrend market

Downtrends are tough to predict, but if you spot the five signs that you're in one, it can help you adjust your strategy for trading and investing.

Here are the five signs to watch for:

1. A decrease in volume and market share. When a market is trending, investors tend to flock to buy stocks, driving up prices and creating more demand.

But during a downtrend, fewer people are buying shares, meaning that those who are already invested have more of an impact on the price of a stock.

This means that stocks may be bought and sold less frequently and at lower prices overall.

2. Prices moving in tandem with one another rather than independently. When markets trend upward or downward, individual stocks will usually move together in lockstep – rising or falling together as one unit.

3 . Downtrends in stocks tend to be more severe than uptrends. A downtrend in a stock is when the stock price loses value over a period of time, often for several months or more. The length and severity of a downtrend will vary from one stock to another.

4 . In a downtrend, the longer the downtrend, the greater the potential loss. This is because you're buying at a lower price and selling at a lower price while the value of your investment decreases.

5 . A downtrend can be broken by buying low and selling high.

How to trade a downtrend

When a market is in a downtrend, it can be difficult to make money.

However, there are a few things you can do to make sure that you're making the most of this downtrend.

- First, try to identify the trend. Once you know what's going on, you can trade with confidence.

- Second, focus on buying low and selling high. This will help you make money while the market is down.

- Finally, stay disciplined and don't overtrade. If you do these things, you'll be able to profit from the downtrend without too much difficulty.

How to trade a rangebound market

When the market has been ranging for a while, it's time for you to start trading.

The idea is the same as with a downtrend: buy low and sell high. If the market is ranging, look for a low point to enter the market.

Put a buy order at or above that level. Wait for confirmation of your entry, then place a second buy order at or above where you think the next low will be. Wait for confirmation.

Once you have the price where you want it, place a third buy order at or above that level.

Wait for the confirmation and then place a fourth buy order at or above that level. After placing these four orders, wait for prices to confirm before you take any action.

How to identify a downtrend

If you are looking to identify a downtrend, there are some key things to keep in mind. A downtrend is generally characterized by a decline in prices over a period of time.

The price may go down gradually or quickly. And the trend may be clear or hidden.

However, identifying a downtrend isn't always easy, so it's important to use caution when making assumptions about the state of the market.

What causes a downtrend

There are a few things that can cause a downtrend. A company may be experiencing financial difficulties and may be selling off its assets to try and shore up its finances.

Alternatively, a market trend could change, causing the prices of stocks or other assets to decline. Finally, a company's stock price may simply fall below what is considered an appropriate value by investors.

In conclusion, by following the tips provided in this article, you can start to read and understand crypto charts. By doing so, you will be able to make more informed investment decisions, and hopefully, make some profits in the process.